If you have ever tried to read through an annuity contract, you know it can feel like deciphering a foreign language. There is no shortage of fine print, confusing riders, and layers of guarantees that seem to promise peace of mind but often leave investors asking, “What did I actually buy?”

This post marks the beginning of a new series that will unravel the mystery behind annuities and the confusion that surrounds them. Over the next few months, during my rotation on the blog schedule, we will explore what annuities are, how they work, and why they are so often misunderstood. We will also look at when they can make sense, and more importantly, how to evaluate whether keeping them or creating an exit strategy aligns with your long-term goals.

A Personal Shift in Perspective

Before joining LeConte Wealth, I spent several years on the product side of the financial industry. I worked for a firm that specialized in annuities and structured product sales. During that time, I gained a deep understanding of how these contracts were built and why they were so widely sold.

But I also noticed a troubling pattern. The system was designed to favor the product, not the person. High commissions, complex surrender schedules, and limited flexibility often left clients with less control and fewer options.

Kevin and Hoy recognized the same issue when they founded LeConte Wealth. They believed there had to be a better way to help clients manage their finances than by selling products. Their vision for LeConte was built on a simple principle: always do what is right for the client.

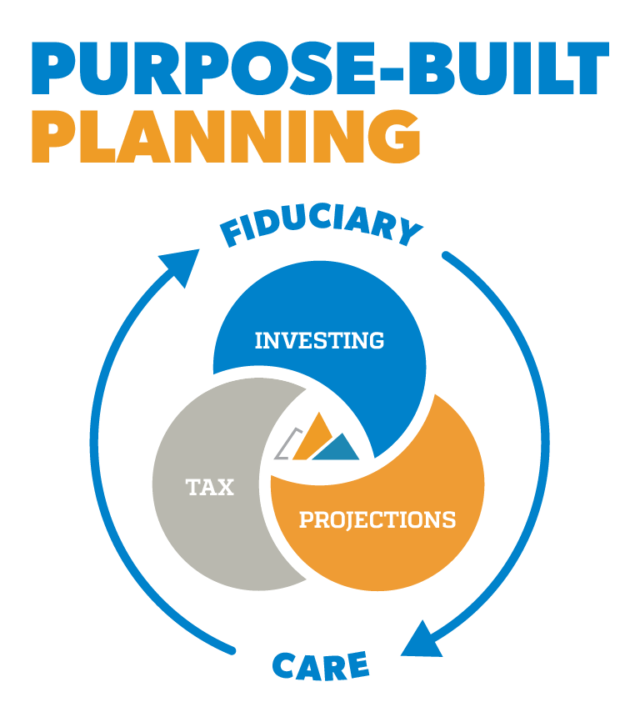

That belief was a major reason I joined this firm. As a fiduciary, fee-based RIA, our advice at Leconte Wealth is guided by values, not commissions. We believe transparency, education, and accountability are essential to helping clients make confident, informed decisions about their wealth. This is why the team created Purpose-Built Planning.

The Good, the Bad, and the Confusing

The Good, the Bad, and the Confusing

Annuities were originally designed with a noble purpose: to provide guaranteed income and protect people from outliving their money. On paper, that concept sounds great. In practice, however, the execution often falls short.

Here are some of the most common issues we see when reviewing client annuity contracts:

- High internal costs that quietly erode returns

- Surrender periods that lock investors into their contracts for years

- Limited and confusing investment options that make performance tracking difficult

- Complex riders that sound reassuring but rarely justify their cost

Understanding these layers is the first step. Once we can see what is inside the contract, we can help clients evaluate whether it still serves their best interests.

What This Series Will Cover

In the coming weeks, we will take a closer look at the different aspects of annuities and how to navigate them with confidence:

- The anatomy of an annuity and how the moving parts work together.

- The variations of annuity contracts, including index, fixed, and variable annuities.

- When they might be appropriate, and the difference between fee-based advice and commission-based products.

- Alternative solutions and how to transition toward more flexible, transparent, and diversified investment options.

The Goal of This Series

This series is not about criticizing annuities or the people who sell them. It is about creating clarity and confidence for clients who want to understand their financial picture.

At LeConte Wealth, we believe that good advice begins with transparency and education. If you have an annuity and are unsure about what it is doing for you, this series will help you see the full picture and make a more informed decision about your financial future.