When it comes to personal finance, taxes are one of the largest expenses most people face. Yet, many taxpayers don’t fully understand how the U.S. tax bracket system works or how to use it to their advantage. Strategic use of tax brackets, known as tax bracket utilization, can make a significant difference in how much you keep in your pocket and how effectively you plan for the future.

I can’t count the number of times that I’m asked, “how come the rich don’t have to pay taxes and I do” or “can you make my tax bill zero like Elon Musk”. Often these questions are in jest, but many times they come from a misunderstanding of how United States taxes work and how we can let the law work for you too.

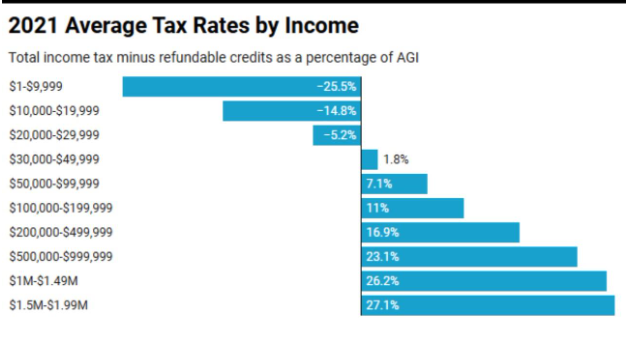

The image below shows the IRS reported average rate of tax paid by Adjusted Gross Income. The IRS always takes a few years to get these numbers out, so this report was from the 2021 filing season. As you can see, below $30,000 in income on average pays no income tax and, in most cases, receives money back. Actually, anyone below $200,000 pays a very low percentage of income tax by staying at an average of 11% or below. You can also see the largest burden of tax is carried by those making over $500,000.

Understanding Tax Brackets

Understanding Tax Brackets

The U.S. tax system is progressive, meaning income is taxed in layers. Instead of paying one flat percentage on all your earnings, each portion of your income is taxed at the rate of the bracket it falls into.

Why Tax Bracket Utilization Matters

Strategically using tax brackets can allow you to do many things, but below are four major advantages:

- Minimize Tax Liability – Through careful planning, you can shift income or deductions across years to stay within a lower bracket. For example, deferring income or increasing your 401(k) contributions might help you avoid creeping into a higher bracket.

- Maximize Retirement Withdrawals – In retirement, you may have flexibility in how you draw income from Social Security, pensions, taxable accounts, and tax-deferred accounts. By “filling up” lower tax brackets with withdrawals, you can manage your long-term tax exposure and avoid large tax bills later. It’s all about the lifetime tax rate.

- Manage Capital Gains – Selling investments can trigger capital gains, which add to your taxable income. By strategically timing sales, you can avoid pushing yourself into a higher bracket or take advantage of the 0% capital gains rate if your taxable income is low enough. Multi-year tax planning can help you maximize the benefit of capital gains.

- Plan for Required Minimum Distributions (RMDs) – Once you reach a certain age, you’re required to withdraw from tax-deferred accounts like traditional IRAs and 401(k)s. If not managed early, these withdrawals could push you into higher brackets later. Utilizing tax brackets in earlier years (via Roth conversions, for example) can smooth out your tax burden.

Tax bracket utilization isn’t about gaming the system – it’s about making informed, proactive choices that align with your financial goals. Over a lifetime, effective use of tax brackets can mean thousands of dollars in savings, smoother retirement income, and a more efficient legacy plan.

The process to achieve this tax bracket utilization is challenging and can change yearly based on new tax laws and age impacts. Therefore, you often need a professional to walk through this process with you. Getting a full financial picture and being prudent is impossible without layering on tax strategy. We would appreciate the opportunity to walk alongside your household and make your full picture more tax efficient.