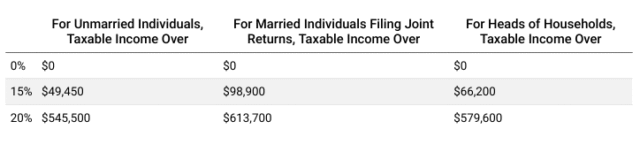

The IRS just announced the long-term capital gains brackets for 2026, and the news offers some encouraging opportunities for those with income under certain levels. If you’re married and filing jointly with taxable income under $98,900 – or single with taxable income under $49,450 – you’ll pay zero percent on long-term capital gains. Zero! That means you could sell investments you’ve held for more than a year, realize a gain, and potentially owe nothing in federal tax on those proceeds.

To see how this works, let’s walk through an example.

Imagine a retired couple whose adjusted gross income is $120,000. They take the standard deduction, which will be $32,200 in 2026 (or more depending on if their age 65+ and income is under a certain threshold), leaving them with $87,800 of taxable income. That keeps them under the $98,900 threshold. If they decide to sell an investment and realize $8,000 in long-term capital gains, those gains would fall into the 0% bracket. In other words, they could add extra retirement income without paying additional tax.

This is where Purpose-Built Planning really shines. When we’re helping clients plan for retirement income, we look at the whole picture: Social Security, pension payments, IRA withdrawals, and even part-time work. Then we layer on investment decisions like capital gains. The goal is to use the tax rules to your advantage, keeping your income in the most favorable bracket possible. Just last year, for example, we helped a family who was in the 24% marginal tax bracket pay an effective tax rate of only 8.36% by using various tax strategies such as realizing long-term capital gains at 0%.

And it’s not just about gains. Losses can be part of the strategy too. Through tax-loss harvesting, you can sell investments that are down, use those losses to offset gains, and even reduce up to $3,000 of ordinary income each year. That flexibility gives you more control over your cash flow and taxes in retirement.

Too often, I meet with prospective clients who have been caught in the middle between their financial advisor and their tax preparer. The advisor asks them to pass messages to the tax preparer, and the preparer sends messages back through the client to the advisor. Inevitably, details get lost or misinterpreted, and tax or investment mistakes occur. One of the most valuable aspects of working with LeConte is that most of your financial list is handled under one roof by a highly collaborative team.

The doesn’t line is that retirement income does not just happen. It is managed with intention. The 2026 capital gains brackets give retirees a powerful tool, but it takes careful planning to know when to use it. That is why we believe in Purpose-Built Planning. It’s not about chasing the market or reacting to headlines. It’s about aligning your money with the life you desire to live, keeping more of what you’ve earned, and enjoying the freedom you’ve worked so hard for.