In the first post of this series, we discussed why annuities often leave investors feeling confused about what they own. That confusion is not a reflection of poor decision making or a lack of financial knowledge. More often, it is the result of how these products are constructed.

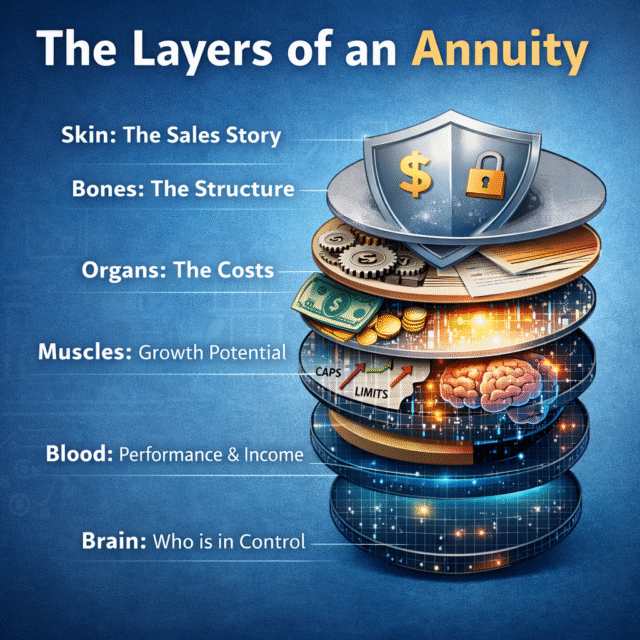

Annuities are layered contracts with multiple moving parts that rarely get explained clearly. In this post, we are going to take a closer look inside. By breaking an annuity into its core components, it becomes easier to understand how it works, where the costs live, and why evaluating these products can be so challenging.

Why Annuities Feel So Complicated

Most financial products can be explained in just a few pages. Annuities often come with contracts that are dozens of pages long (or a book!), supported by riders and disclosures. Each feature may serve a purpose, but when combined, clarity is often lost.

Guarantees come with conditions. Benefits come with costs. Flexibility often comes with penalties. Without breaking the contract into individual parts, it is difficult to understand how everything works together.

The Skin: What You Are Shown

The outside of an annuity is the sales story. This is where words like safety, income, and protection are emphasized. These ideas resonate with investors, especially those approaching or already in retirement.

There is nothing wrong with these goals. The challenge is that the surface level explanation rarely includes the tradeoffs needed to achieve them. What is presented is designed to feel reassuring, not educational.

The Bones: The Structure

The foundation of an annuity consists of the premium invested, the accumulation value, and the surrender schedule. This structure plays a strong role in how your money can be accessed and when.

Surrender schedules are one of the most restrictive features of annuities. They often last many years and impose penalties for early withdrawals. While they help insurance companies manage risk, they significantly limit an investor’s flexibility. Many clients are surprised to learn how restricted their money really is.

The Organs: The Costs

Inside the contract there are ongoing costs such as mortality and expense charges, administrative fees, rider costs, and underlying investment expenses. Individually, these fees may seem manageable. Together, they can meaningfully reduce long term returns.

Because these costs are embedded within the contract, they are easy to overlook. Over time, however, they have a significant impact on performance. This is one of the first areas we evaluate when reviewing an annuity.

The Muscles: Growth Potential

Growth within an annuity depends on the available investment options or index credit methods. In multiple cases, these options are limited and confusing. Investors often assume they are fully taking part in the market growth, only to discover performance caps, participation limits, or restricted fund choices.

While these features may reduce downside risk, they often limit upside potential as well.

The Blood: Performance and Income

Performance reflects how all the internal systems work together. When costs are high and growth is constrained, returns may fall short of expectations. Income riders can provide predictability, but they often do so by reducing liquidity and long-term flexibility.

This is where many investors begin to feel the disconnect between what they expected, and what the annuity truly delivers.

The Brain: Who Is in Control

At the center of every annuity is the insurance company. It controls the rules, pricing, crediting methods, and allowable changes to the contract. While these companies are regulated and financially strong, their primary responsibility is to their own balance sheet, not an individual investor’s broader financial plan.

Understanding who controls the contract helps explain why annuities function the way they do.

The Heart: Why People Buy Annuities

Despite their complexity, most annuities are bought with good intentions. Investors are seeking income, stability, and peace of mind. These goals are valid and deserve respect. Our role is not to dismiss those intentions, but to ensure the solution truly supports them.

Why This Matters

When you step back and view an annuity as a complete system, the complexity becomes easier to see—and harder to ignore. Every feature has a purpose, but every layer also adds cost, constraints, and tradeoffs.

At LeConte Wealth, we believe financial decisions work best when they’re built on clarity, not confusion. Acting as a fiduciary means helping clients understand what they own, how it works, and whether the complexity truly adds value to their broader plan. When a product requires constant explanation, it deserves a closer look.

What’s Next in the Series

Now that we’ve broken down the internal anatomy of an annuity, the next step is understanding the different types available today. While often grouped together, fixed, indexed, and variable annuities function very differently – each with unique costs, risks, and tradeoffs.

In the next post, we’ll walk through these structures in plain language so you can better understand how they work and decide whether the complexity actually supports your goals or simply adds unnecessary strain.