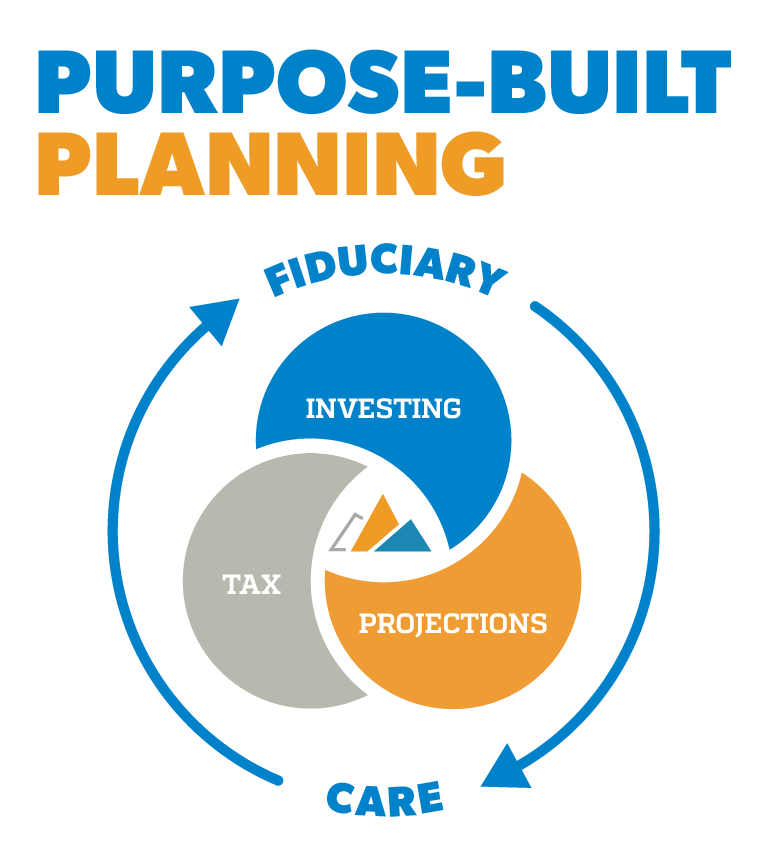

Purpose-Built Planning is at the forefront of our asset management approach. Your unique financial and behavioral characteristics shape the solution that we recommend. With more than $300 million in managed assets, LeConte has access to the most current investment strategies at a very low cost. We no longer rely on old-fashioned, expensive mutual funds to invest our clients’ funds.

LeConte has access to all potential investment markets. Exposure to stocks, bonds, precious metals and commodities provides the opportunity to pursue your goals. We employ a prudent decision-making process that avoids speculation.

Household Portfolio Construction

We build custom portfolios across all of your investment accounts that work in harmony to meet your risk tolerance and accumulation goals. With accounts larger than $100,000, we start with companies that are represented in established stock index listings (S&P 500, NASDAQ, Mid and Small Cap).

From these companies we build individual stock positions (typically 150-350 stocks) in the account. This provides complete transparency to you. Your monthly report shows exactly where your accounts are invested. This process efficiently reduces or eliminates costs associated with mutual funds and exchange traded funds (ETFs). It also provides greater tax efficiency than using packaged products.

From these companies we build individual stock positions (typically 150-350 stocks) in the account. This provides complete transparency to you. Your monthly report shows exactly where your accounts are invested. This process efficiently reduces or eliminates costs associated with mutual funds and exchange traded funds (ETFs). It also provides greater tax efficiency than using packaged products.

Portfolio Investment

As fiduciary investment managers, we analyze potential investment risk, cost and liquidity to ensure that they are appropriate for our client portfolios. This is an ongoing process. When markets change, we adapt to capture the benefits for our clients.

As you transition from accumulating assets in your accounts to withdrawing funds, we adapt our portfolio to meet your changing needs. When producing reliable income becomes more important than future growth, we use our deep bond market expertise to further customize your portfolio to produce reliable, tax-efficient income

As you transition from accumulating assets in your accounts to withdrawing funds, we adapt our portfolio to meet your changing needs. When producing reliable income becomes more important than future growth, we use our deep bond market expertise to further customize your portfolio to produce reliable, tax-efficient income