Your Questions

Our Solutions

Purpose Built Planning is much more than basic investment management.

We connect all of your financial dots in order to provide you with an overall plan to meet your financial goals. We have experience in all financial products – equities, bonds, insurance, taxes, and estate planning – in order to make the right recommendations for your personal situation.

Purpose Built Planning tax service ensures you only pay the I.R.S. what you are required to – now and in the future.

It depends on how your financial professional is compensated. Investment brokers and insurance representatives rely on product commissions for the majority of their income. These fees may be obvious or hidden.

We are fee-based fiduciary advisers so we do not charge brokerage commissions. Purpose Built Planning’s transparent fees are aligned to your financial success. If we grow your assets, we earn more, if we don’t, we earn less. Our rates decline as your assets increase You can find details listed here.

There are a number of different designations that financial professionals use.

While a financial planning professional can have any of several designations or certifications, at the very least you should make sure that he or she is licensed and in good standing with the licensing authority.

The most common designations are Certified Financial Planner, Certified Public Accountant and Investment Adviser Representative.

Choose a financial planner who has experience dealing with clients in similar circumstances to yours. You’ll also want to make sure that the financial planner has your best interests in mind, and that he or she isn’t selling you products that are not suited to your needs.

Ask about unique products or services that they provide to their clients.

Interview prospective financial planners and ask them about credentials, management strategies, and investment philosophy. Ask for local references.

No. Individual tax services are included in your Purpose Built Planning fee.

What Can I Expect

Working with LeConte?

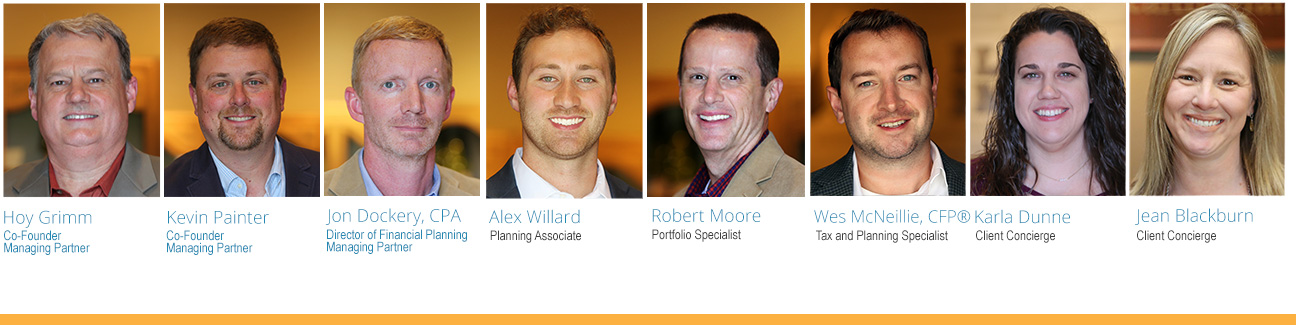

When you take the step to use Purpose Built Planning, our team of service, tax and investment professionals coordinate your transition to LeConte.

We simultaneously:

- Develop your financial roadmap

- Gather your tax details

- Open the accounts necessary to pursue your goals.

We look at your complete financial picture. We first want to understand the steps that you have already taken. Through one-on-one interviews, we dig into any financial roadblocks that may derail your goals.

Humans are often their own worst enemy when it comes to money. Purpose Built Planning relies on up-to-date behavioral science to address the deep-rooted psychological biases that prevent most investors from achieving their goals.

“Risk” is a loaded word that can be used by investment sales people to elicit greed or fear. We teach you to understand risk & how to implement it effectively so that your emotions don’t distract you.

None of the Investment Adviser Representatives at LeConte are compensated from brokerage commissions. Purpose Built Planning is a fee-based advisory service. Your fee covers all of the services we offer and access to our entire team of experts.

While your financial planner may make a different recommendation based on your particular circumstances, it’s a good idea to see him or her once or twice each year.

You should also consider making an appointment in anticipation of life-changing events such as marriage, the birth of a child, divorce, or after inheriting a large amount of money.