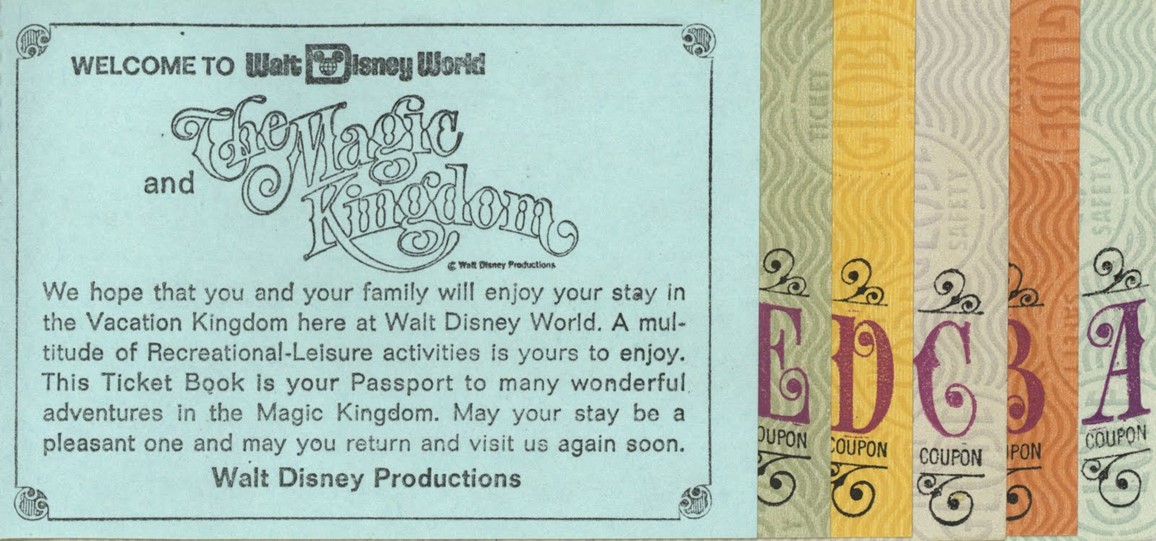

Walt Disney World is celebrating their 50th anniversary since opening in central Florida in October 1971. I lived in Orlando at the time and have fond memories of those early visits. OG visitors to the Magic Kingdom (which was the only park open then) paid a modest sum for park admission and then bought additional tickets to ride and enjoy the other attractions around the park. Your ticket book started with this greeting: “We hope that you and your family will enjoy your stay in the Vacation Kingdom here at Walt Disney World. A multitude of Recreational-Leisure activities is yours to enjoy. This Ticket Book is your Passport to many wonderful adventures in the Magic Kingdom. May your stay be a pleasant one and may you return and visit us again soon.”

The most economical way to buy tickets was in book form where you received an assortment of tickets ranked from A-E. The best rides required the scarce “E” ticket from your book. Disney bonus trivia- ride tickets were interchangeable between Disneyland in California and Walt Disney World in Florida. The parks experimented with all-day passport admissions for their season ticket holders in the late 70’s. When EPCOT opened in 1982, Disney World abandoned ticket books entirely.

Flash forward to October 2021. The “happiest place on earth” is adding back individual ride tickets with a technology twist. Disney has introduced a new mobile app called Disney Genie + that will function like a 70’s era ticket book. On top of their $100 plus park admission, visitors can pony up an additional $15 bucks per person to “skip the line” at key attractions (more mouse trivia it costs $20 per person, per day at Disneyland).

Disney designed Genie+ with an intentional flaw- not all rides offer skip-the-line on the app. For the “E” ticket rides you’ll have to pay an additional fee for the “Individual Attraction Selection” service. On the upside though if you take your family to Florida to visit Star Wars: Galaxy’s Edge, you no longer face the risk of missing “Rise of the Resistance. It’ll cost you, but you’ll be able to get in.

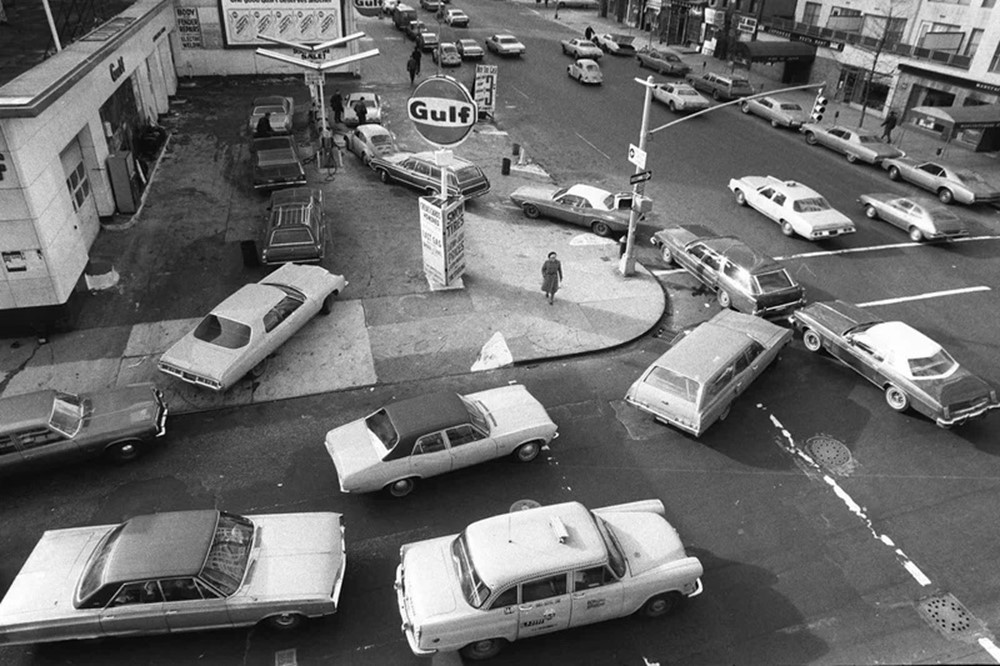

Guess what else has returned from the 70’s just in time to haunt us? Inflation. I have vivid memories of waiting in line to gas up the family vehicle because oil companies were forced to ration supplies.

Politicians, Fed policymakers and investment market participants are all debating how long this inflation scare will last. We’ve all felt it in some way. Crude oil prices have doubled in the last 12 months. This has and will lead to more inflation as higher crude filters through to higher gas price, higher shipping costs, higher manufacturing costs, etc..

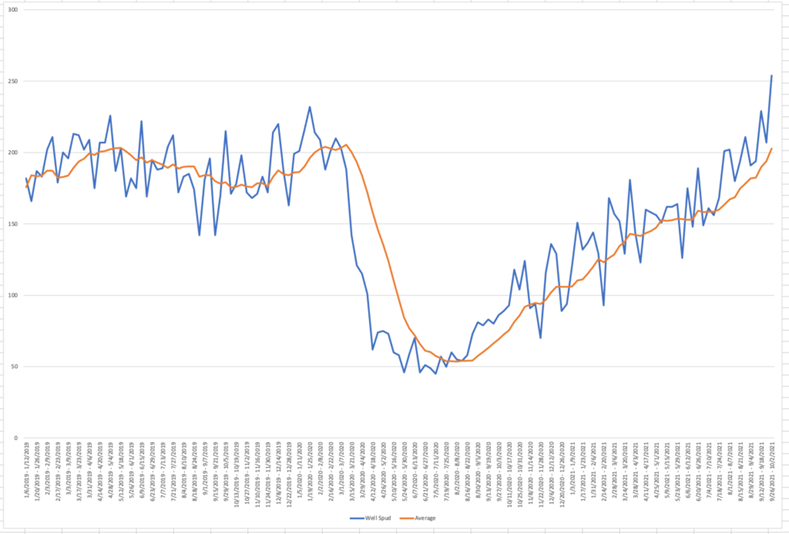

Energy inflation is fickle though. When prices rise, oil companies rush to capitalize and pump more oil out of the ground to sell. The first place we see this is in permit applications for new oil rigs. For reference the low point in the chart below is right after we reopened the country after Covid lockdowns in June 2020.

As new rigs are erected and begin pumping, the new supply pours into markets and eventually drives prices back down. It’s a worthwhile debate to discuss what would have happened to oil prices if President Biden didn’t revoke the Keystone XL pipeline permits in his first act of business on January 20th. His decision cost 1000 union jobs and halted 800,000 barrels of oil from flowing from Canada to Texas.

Supply chain disruptions make inflation problems feel worse for consumers right now. In a recent discussion with a local big box, home goods retailer, the store manager lamented that they were still waiting on seasonal fall and Halloween product deliveries. The reality is that when they eventually arrive (after the holiday) the products will be unloaded and go directly to the 50% off rack in the store. This is deflationary. Washington continues to unwind temporary COVID stimulus programs. This is forcing idle workers back into the workplace.

More workers in the workforce will cap wage increases and employers won’t be forced to fill openings with signing bonuses. For these reasons and more, the Federal Reserve expects inflation to subside next year. That’s not the consensus of financial pundit but I agree with the Fed’s expectation with one caveat – Congress’ desire to pass a budget busting, inflationary spending program before the end of the year. If they force through a 1-3 trillion spending boondoggle right now, inflation will get worse.

For now, your family trip to Disney World is going cost a lot more. Not only are the Parks reaching into your wallet but the cost to travel there will hurt more too. Might be a good time to stay home and watch Jungle Cruise on Disney’s streaming service instead of riding it in Florida. If Congress shows spending constraint (I’m not holding my breath), we can plan for more affordable vacations next summer.

Happy Halloween.