If you are earning less than 4.5% on your bank savings dollars, you are giving your bank permission to steal from you.

Over the past few weeks, I’ve had multiple conversations with clients, friends and family about banks and other investment companies offering them alternatives to the traditional savings account. The most common alternative offered has been a 13-month CD paying around 4.25%. Although 4.25% is much better than the national average APY for savings accounts, 0.33% in January according to the FDIC, savers can still do better. How so, you may ask?

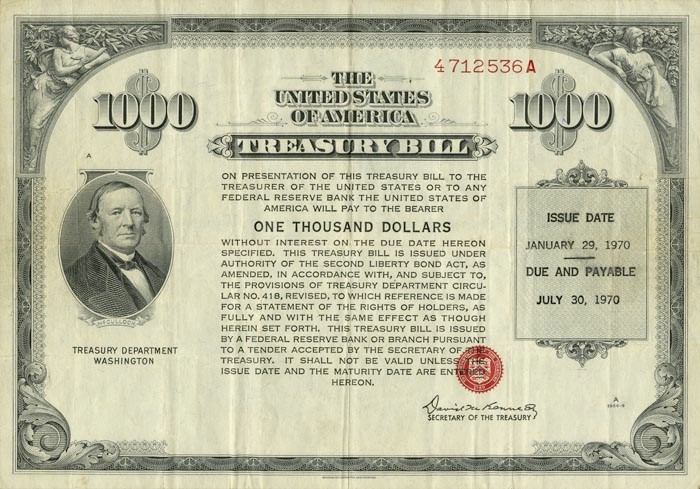

Much like your local municipality *offering bonds, the U.S. Treasury Department issues investments called Treasury Bills (T-Bill, for short). A T-Bill is a short-term (1-year or less) U.S. government debt obligation. These “bills” are sold in denominations of $1,000 and are considered to be a “risk-free” investment, as they are backed by the full-faith of the U.S. Treasury.

After treasury yields have fallen consistently since peaking in the early 1980s, treasury rates have risen significantly since their all-time lows in 2020. As of this past week, a 1-year Treasury is now yielding greater than 5%. So, if you purchased 1-year T-Bills with $100,000, in 1-year you’ll have made roughly $5,000 in interest. Beats a couple of hundred bucks from a traditional savings account, right?

Savers haven’t had an opportunity like this in more than 15 years, so at LeConte, we’ve encouraged our clients to take advantage of this opportunity by moving their idle cash to one of the many high-yielding alternatives available (at the minimum, a high-yield savings account).

Our process, Purpose Built Planning™, allows our team to focus on opportunities as discussed above. If you or someone you know needs a financial fiduciary, don’t hesitate to contact us. Our team stays focused on client dreams and the best way to pursue them.

For more information, give us a call (865) 379-8200 or visit our website at lecontewealth.com