Our clients and social media followers know that we have been encouraging savers to pull money from their low yielding bank accounts and put it into short-term Treasury obligations. If you do, you’ll earn more than 5% (annualized) for six month to 12 month terms.

When considering your options there are subtle differences between the various Treasury obligations. Understanding these quirks can increase your yield. The United States Treasury borrows money every week by issuing new government backed Bills, Notes and Bonds. Weekly Treasury Bills are all issued with a maturity of 1 year or less. Notes are issued with maturities out to 20 years. Obligations with maturities longer than 20 years are referred to as Treasury Bonds.

On Tuesday, Feb 21st, the Treasury issued new 52 week Bills at a yield of 5.046% (Auction results) which is a huge increase from February 2022 when yields were less than 1%. Savers ramped up Google searches for “Treasury Direct”, the government site where investors can buy new Treasuries at auction commission-free.

Treasury Direct is a safe and simple resource to access new issues. There are other buying avenues to consider that savvy investors use to receive the most competitive rates. I’ll explain with an example: a couple of years ago, the Treasury issued a new (at the time) 3-year Treasury Note. Here are the pertinent details:

Issue Date: 3/15/2021

Maturity Date: 3/15/2024

Coupon: 0.25%

Flash forward to 2023. An investor that bought those Notes in 2021 needed to sell them now. Why they needed to sell is not important. What is important is that rates are much higher now than when this bond was issued 2 years ago. This impacts the price they will receive for the old note that they need to sell. Their note still has one year until it matures. The current one year T-bill is paying over 5%, so the investor selling their old note will have to sell it a low enough price to generate at least 5%. Whoever purchases it will earn a competitive rate of return compared to new issues. With a coupon rate of only 0.25% these “off-the-run” notes do not pay anywhere near what a new T-bill pays. The only way to entice a buyer is to dramatically lower the price of the old notes to make up for the lower rate of interest it pays.

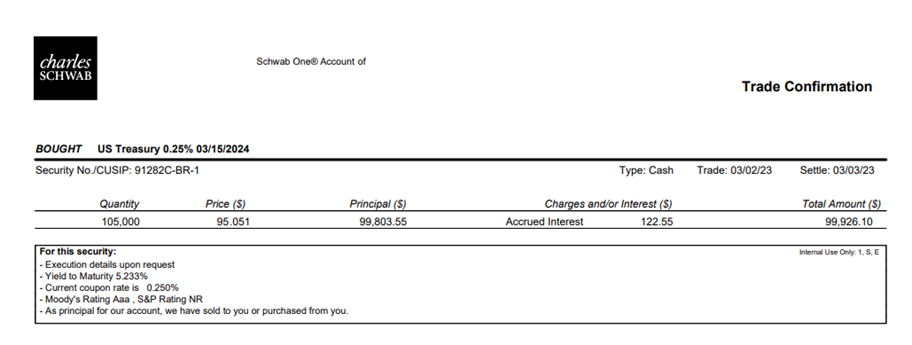

This isn’t a hypothetical. I actually bought $105,000 of these seasoned notes for a client this week. Here are the details of the purchase:

I paid $99,803.55 for the Notes. Our client will earn $262.50 in interest over the year, but they will receive a bit more than $105,000 when it matures on the Ides of March 2024. By opting for the seasoned Treasury Note, our client locked in a yield of 5.23%* instead of the 5.04% from a new issue at Treasury Direct.

There is a tax deferral advantage from these seasoned securities. This year, our client will only receive a $131.25 interest payment in September. That will be taxable income for 2023. Most of the earnings will be paid at maturity in 2023 when he receives $105,262.50. Income tax will not be payable on it until tax filing in 2024. That is a long time to compound the earnings windfall before giving some up to the IRS.

Investors cannot buy seasoned Treasury obligations from Treasury Direct. As fiduciary asset managers we remain diligent to find the best option for our clients’ short-term, safe money. This is a real-world example that will put an additional $200 in our client’s pocket over what the client would have earned going to Treasury Direct. If your bank is paying you less than 5% on your short-term funds, let’s talk about the higher yield options available to you.

*Treasury yield was 5.23% as of 03/02/2023. Treasury yields may fluctuate on a daily basis. Past yields are no guarantee of what future yields may be. This is not a promise of a specific rate of return, but rather an example of yields and prices on a specific date and time.