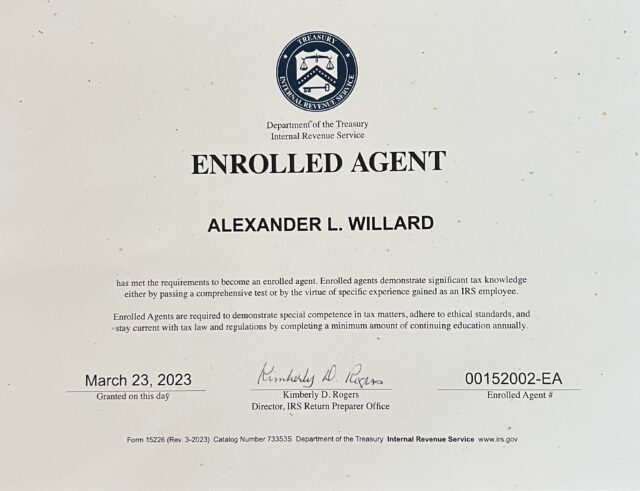

Complete EA:

Over the past 3 years of my professional career, I’ve worked toward becoming an IRS Enrolled Agent (EA). An EA is a tax professional who is authorized by the US federal government to represent taxpayers before the Internal Revenue Service (IRS) for tax-related matters. Regarding functions, EAs are authorized and qualified to provide a wide range of tax-related services, including:

- Preparing and filing tax returns: EAs can prepare and file tax returns for individuals, businesses, estates, and trusts.

- Tax planning and advice: EAs can provide tax advice and help clients plan for future tax obligations.

- Representation: EAs can represent clients in front of the IRS for tax-related issues, such as audits, collections, and appeals.

- Compliance: EAs can help clients comply with tax laws and regulations to avoid penalties and interest.

This experience has taught me a lot about myself, but as a financial advisor, I’ve ultimately learned that having a strong understanding of tax laws and regulations can be crucial in providing comprehensive financial planning and investment advice to clients. Yes, I can now provide a wide range of tax-related services, but what’s more critical to our business are the following:

- Understanding the tax implications of investment decisions

- Providing tax planning and advice

- Helping clients navigate complex tax and planning issues

- Building a deeper trust with clients

At LeConte, our service is called Purpose Built Planning™. It is designed to provide fiduciary advice tailored to a client’s unique needs. We examine our client’s past financial efforts, evaluate their habits under present financial conditions to launch clients towards their unique financial purpose. Our team navigates financial and behavioral potholes by combining asset management (investing), financial planning and tax planning/preparation. We go deeper in understanding their goals through thought provoking questions:

“What keeps you up at night?”

“What is your greatest fear about the way you are currently living?”

“In your prior financial experiences, what were your proudest moments and biggest regrets?”

Our advisors use these conversations to assemble an in-house team of subject matter experts in asset management, tax and complex planning. They custom-tailor our services to help clients realize their financial purpose. If you or your business would like to learn more about how our team can help, don’t hesitate to reach out.