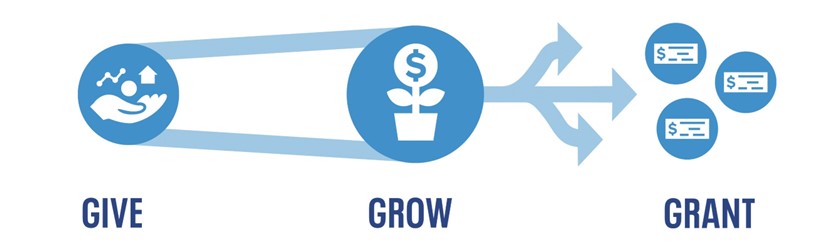

One of our retired clients approached us earlier this year asking about leaving a legacy. They were reflecting on their estate plan and how to create a lasting impact for causes they were passionate about. We created a strategy using a Donor Advised Fund to help them align their charitable giving with their goals, maximize tax benefits and engage in purposeful philanthropy. Donor Advised Funds (DAFs) are an excellent choice for retirees seeking to create a meaningful legacy in the following ways.

Streamlining Charitable Giving

Retirees often have diverse charitable interests and are often approached by many organizations (i.e., letters in the mail) for donations. DAFs simplify this process by consolidating charitable giving into one account. The donors are then enabled to manage and distribute funds from their account to multiple charities and causes.

Tax Advantages

Investing in Donor Advised Funds offers significant tax benefits for those donors. By contributing appreciated assets such as stocks, mutual funds, or real estate to a DAF, retirees can avoid capital gains taxes on the appreciation. Additionally, they can take an immediate tax deduction for the fair market value of those contributions to the DAF, potentially reducing their taxable income. The tax advantages can optimize the donor’s giving capacity while providing valuable savings for their overall financial plan.

Philanthropic Legacy

Our client had a wish to leave a meaningful legacy and support causes they are passionate about. Donor Advised Funds provide clients with the opportunity to shape their legacy by involving their loved ones. Retirees can designate successors, such as children or grandchildren, who can continue the family’s philanthropic traditions by advising on how the money is given away. This fosters a sense of shared values and allows the client’s legacy to live on through future generations.

Strategic Giving and Impact

Our retired client wanted to make a meaningful difference with their charitable contributions. DAFs empower clients to engage in strategic philanthropy, researching new causes and organizations that they previously knew nothing about. They can identify organizations that align with their values to have a measurable impact on the communities and causes they care so deeply about.

By investing in Donor-Advised Funds, retirees can streamline their giving, optimize significant tax benefits, involve their children in their philanthropy, and think strategically to provide a lasting impact. It’s a wonderful tool that we use in broader charitable and estate planning discussions with our clients. Our team can help our clients transform their resources for the greater good and create a legacy that reflects their values and passions.