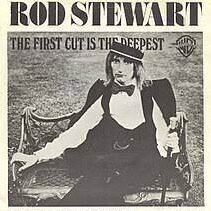

Cat Stevens wrote a song about the perils of falling in love in 1967 titled, The First Cut Is The Deepest. A young soul artist named P. P. Arnold left her spot as an Ikette for the Ike and Tina Turner group to pick the song up. She released it later the same year. I wonder if Stevens anticipated how long the song would endure in the global music landscape? Several artists through the decades covered Stevens’ composition – Rod Stewart in 1977 is the version that I am most familiar with. Swedish rapper Pap Dee covered it in 1995 and Sheryl Crow did in 2002.

“I would have given you all my heart,

But there’s someone who’s torn it apart”

With deference to their musical work, I think the song applies to what the Fed’s been doing with interest rates. Last summer, rates were 4% lower than they are today. Bond investors suffered through the worst calendar year performance in history in 2022. The upside of last years’ pain is that savers are finally earning a great rate on their idle cash. In the summer of 2023 5% CD rates are easy to find and short-term Treasury obligations yield over 5.4%. Investors are waiting for the Fed to meet later this month to discern what’s next for rates. Consensus forecast is for the Fed to resume raising rates by .25%. Weaker CPI numbers this week indicate that the Fed’s rate hikes have inflation dropping down to acceptable levels.

“…and she’s taken just all that I had,

But if you want, I’ll try to love again.”

The lag time between when the Fed raising rates and when the effects filter through our large, complex economy is very long. This leads to second guessing by policy makers and investors. As a result, market opinion is split between two narratives – “We’ve started a new bull market for stocks” and “A recession is right around the corner.” Both views can find facts to support their opinion. Stocks did good in the first 6 months as earnings and consumer activity delivered resilient corporate profits. Corporate layoffs, lower CPI and other deflationary measures point to a weaker economy. These conflicting data points have folks asking if the Fed may snatch defeat from the jaws of victory by tinkering with higher rates when it looks like they’ve already won the inflation war.

“Baby I know, the first cut is the deepest

When it comes to being lucky, she’s cursed.”

The Fed’s aggressive rate hikes to attack post-pandemic inflation are working. The economy is showing clear signs of slowing. At a point, the Fed intends to cut rates, so the economy won’t completely stall out and nosedive into a deep recession. This is where we get the “soft landing” word picture from. Think about the reality of that first rate cut for a minute. If you were shopping for a house/mortgage and the Fed starts cutting rates, how would you react? Most shoppers, sensing what’s coming, would delay major purchases in expectation of even lower rates. This delay in consumer economic activity will make things worse and the Fed will be cursed for waiting too long to cut rates.

We are very near “peak CD rates” for this cycle. When this year’s bumper crop of high yield CD’s and Treasury notes mature next year, savers may be cursed for not locking these great interest rates for more than a year or two. For our part, we’ve pushed investments out into longer maturity bonds so that our portfolio income will be more resilient when rates reverse direction.

Remember, the first cut truly is the deepest.