Have you ever received a flyer that made you take action?

I recently received a flyer from one of the new businesses in town for a free chiropractic exam (side note: I’d never been to a chiropractor), making me consider how taking preventive actions is essential not just for our physical health but also for our financial well-being.

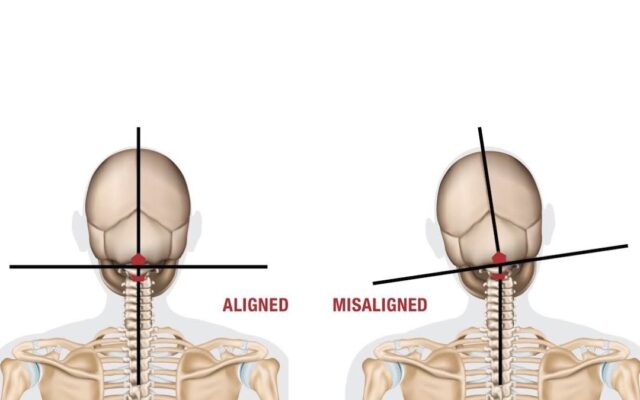

About six years ago, a car accident served as a wake-up call, potentially causing serious injuries. After a hospital visit and recommendations for physical therapy and chiropractic care, I, in my youthful stubbornness, toughed it out, ignoring ongoing back pain. Fast forward to today, and that flyer pushed me to take the overdue free exam. Surprise – my alignment was off with a few other minor issues, drawing parallels with financial health.

Similar to our spine needing proper alignment, so do our finances. Ignoring warning signs can lead to long-term issues and complete dissatisfaction. Our “product” is Purpose Built Planning – our team walks alongside our clients with a fiduciary mindset, asking questions about their past and then looking at their present financial situation, ultimately striving to “Win-The-Future.” Are there debts, neglected investments, budget concerns, and how did they get to their current point? Identifying these misalignments is the first step to a healthier financial future.

Like exercises and adjustments from a chiropractor, we need to make specific behavioral changes to realign our financial path. Sometimes that means pausing to stop the harm being created and reevaluating the specific situation – sometimes less is more. Check your spending habits, savings, and investments. Small, intentional adjustments can have a significant impact over time – think of it as financial stretches and exercises. This is where our team meets with clients on an ongoing basis, retraining bad habits or decisions to become more conscious, good habits.

After my chiropractic exam, the doctor and I discussed a purposeful process to get back in alignment for better overall health. The same goes for finances by creating a purposeful financial plan addressing an individual’s or household’s unique goals. Whether it’s debt repayment, building an emergency fund, or investing to build long-term wealth, having a plan is your roadmap to financial alignment.

Just as my youthful mindset delayed my chiropractor visit, our mindset plays a vital role in financial decisions. Be aware of the psychological aspects of money – emotions, biases, and risk tolerance. Understanding and managing these factors are key to maintaining financial alignment over the long run and turning inaction to action.

So, is it time for your financial checkup? Consider this blog post your flyer for a FREE EXAM. Our team offers a NO OBLIGATION first meeting to sit down and ask us questions. We’ll learn about you, assess your financial situation, identify misalignments, and take intentional steps to realign. Don’t let procrastination be the stumbling block to your financial well-being. If I could go back to the weeks following the accident, I’d take the doctor’s orders more seriously.