Every story has a beginning, and this is the story of the mutual fund. Today, they are ubiquitous in 401k plans, with most workers using them to build a retirement nest egg through small investments from each paycheck they receive. These investments are divvied up into various fund accounts, which, in turn, are diversified into hundreds of individual stocks and bonds. Investors can easily purchase or liquidate a fund, and mutual fund accounting is tightly regulated by the Securities Act of 1933 and the Investment Company Act of 1940, a set of government rules designed to protect investors.

How It Started

A hundred years ago, the pooled investments of the day were small, costly closed-end funds that were often run by dubious characters. Their origins date to London in the 1800s where the investment pooling concept began. On March 21, 1924, a group of well-heeled Boston investors created an innovative investment pool that changed the industry. Unlike the closed-end funds, the trustees offered to repurchase shares from liquidating investors or issue new shares for new investors. They called it Massachusetts Investors Trust. MIT predated the Investment Company Act of 1940 by 16 years. In it’s original form, the trustees worked for investors for a 6% cut of the income from the investments. This cost structure made it the lowest-cost stock fund available, helping MIT rapidly attract assets from investors. From around $3 million in assets in 1926 before the Great Depression, MIT eventually amassed $128 million by 1936 after the depression passed and congress passed the Revenue Act of 1936, which established the tax treatment of mutual funds and their shareholders.

As assets continued to accumulate through the decades, MIT continued to reduce its costs. By the 1960s, fund expenses were less than a quarter percent.

How It’s Going

Mutual funds now hold more than $25 trillion dollars of investor’s money. In 2023, 52.3% of US households owned mutual funds. In 1940, there were only 68 mutual funds. Today there are more than 7,300 funds. If you add all the various share classes, the number of funds offered is over 23,000.

MIT is still in business today, trading under a different symbol and boasting almost 7 billion dollars in assets. Sadly, MIITX nowadays cost investors three times what it cost in the 1960s (0.70% expense ratio vs 0.19%), and the investments in it look similar to the S&P 500 index. Thirty-seven percent of the fund’s assets are in just ten stocks, representing a concentrated bet on a few good but expensive companies.

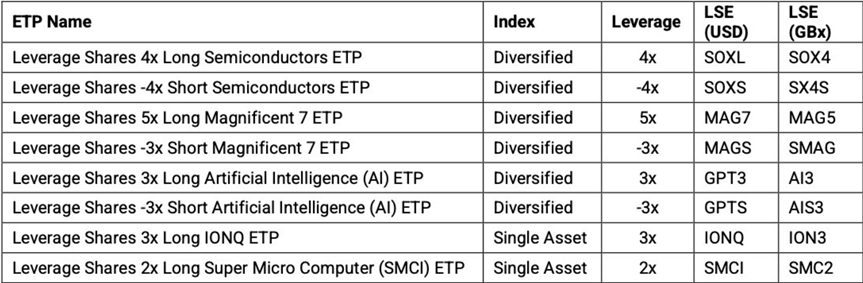

The newest funds registered this year are esoteric offerings for cryptocurrencies and high-risk leveraged bets on last year’s top performing stocks:

Leave it to the grifters on Wall Street to take something that has worked for 100 years and find a fresh way to separate investors from their hard-earned cash.

With so many choices come a mountain of data to analyze. Even a simple 401k plan can offer dozens of investment choices for investors to consider. While I’m not 100 years old like Massachusetts Investors Trust, I do have decades of real-world experience helping investors make sensible choices. Just like the OG MIT trustees back in 1924, LeConte acts as your financial fiduciary to help you invest towards your financial goals. Give us a call to discuss your financial dreams with us.