If you’ve filled up your gas tank, purchased groceries or really purchased just about anything over the past year, you’ve felt your wallet get a little thinner. My co-worker, Wes McNeillie, just recently wrote a blog post titled Time-Tested. If you read it, you’ll remember he referenced our world is “going through another chaotic time with the war in Ukraine, inflation at levels not seen since the early 1980’s, and the Federal Reserve beginning to raise interest rates to combat inflation.” These factors remain true, prompting investors to jockey their positions and ultimately leading investment markets to plunge across the board.

The first four months of 2022 are now in the rearview mirror. With drastic volatility we haven’t seen in some time persisting, investors are continuing to reassess their full financial portfolios. Over the past few weeks, I’ve heard increased conversations around the topic of U.S. Treasury Series I savings bonds. Those conversations have led me to dive a little deeper – mostly since I bonds haven’t been a dinner table conversation in a few decades.

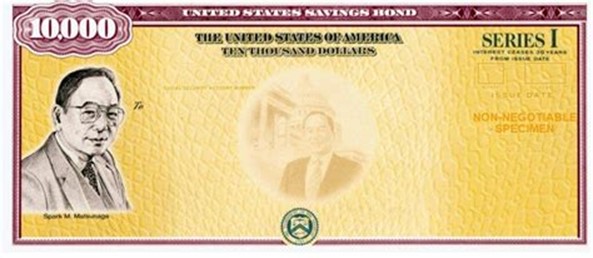

Foreign to many, according to the U.S. Treasury, an I bond is a low-risk investment backed by the U.S. Treasury and “is a security that earns interest based on both a fixed rate and a rate that is set twice a year (every 6 months) based on inflation.” The interest will accrue for up to 30 years. Upon redemption of the bond, the purchaser gets back the face value (original investment), plus the accumulated interest.

***Side Note: The Bureau of Labor Statistics’ latest Consumer Price Index (CPI) and Producer Price Index (PPI) data announcements mid-month came in at increases of 8.5% and 11.2% year-over-year. These numbers are the worst they’ve been in 40+ years.

The last issuance of I bonds occurred in November 2021. This issuance had a fixed rate of 0% and an annual inflation rate of 7.12%. This means if you purchased a $10,000 I bond in November 2021, it would accumulate $712 of interest by November 2022.

But wait… if only it was that easy.

Here is some other information to consider:

- Inflation is not static. The inflation rate is adjusted every 6 months.

- In the above example, the inflation rate would more than likely be adjusted the second six-month period, so the yearly interest earned would be an average.

- Minimum term of ownership is 12 months.

- Interest is compounded semiannually.

- Example: If you earn $356 of interest over 6 months, that is added to the bond’s principal value. Interest is then earned on the bond’s new principal value.

- The fixed rate is fixed. If you purchase an I bond with a 0% fixed rate, you’ll earn nothing from the fixed rate, only the inflation rate.

- You can only electronically purchase $10,000 of I bonds per calendar year (see additional $5,000 paper purchase rule), per spouse. (*A parent must open an account for a child and purchase them on their behalf)

- If you sell an I bond between 12 months and 5 years, you lose the previous three months of interest earned. After 5 years of ownership, there is no penalty.

- The interest earned is taxed at the federal level. You can choose to pay tax on the interest every year the bond is held or upon redemption of the bond.

- Max interest-earning period is 30 years or until you sell them.

The new issuance of I bonds for May 2022 – October 2022 will have an inflation rate of 9.62%, which means you’ll earn at least 4.81% interest within the first 6 months (unless the fixed rate is revised above 0%). If purchasing I bonds make sense for your portfolio and you want to get the clock started, you can learn more here.

Although the above example seems great (and you put it in the right context), especially for those of you who have money you don’t need right now; I bonds certainly do not make sense for every financial portfolio. As mentioned above, the lack of liquidity, no regular cash flow and purchasing limits are each a drawback. If you are thinking about purchasing them, we encourage you to consider your full financial picture. Here at LeConte, our Purpose Built process allows us to regularly meet with clients to reassess their full financial picture. We ask questions like:

- How much risk are you taking across your financial holdings?

- Are you on track to meet your goals?

- Will your investments last in retirement or run out?

- What changes do you need to make to accumulate more?

Simply put, we ask what and why questions. We help clients become purposeful.