Finance + Influencer = Finfluencer, a social media personality that earns money by persuading others to buy promotional products and services.

“They” say 30-seconds is all you’ll need, then you’ll see the Benjamins roll in. If you’ve found that lottery ticket, let me know.

Don’t get me wrong, I’m a huge advocate for financial education. In fact, one of my goals is to push for legislative change to implement more financial education in our school systems. Simply put, a ½ credit through 12 years of education in any state is just not enough. Finance (money) touches almost every part of our society and basic principles need to be taught to provide students a solid financial foundation before they leave the folly of youth behind. If students aren’t learning this knowledge in the classroom and don’t have someone prudent in their life that makes a point to teach them, where will our future generations learn this valuable knowledge?

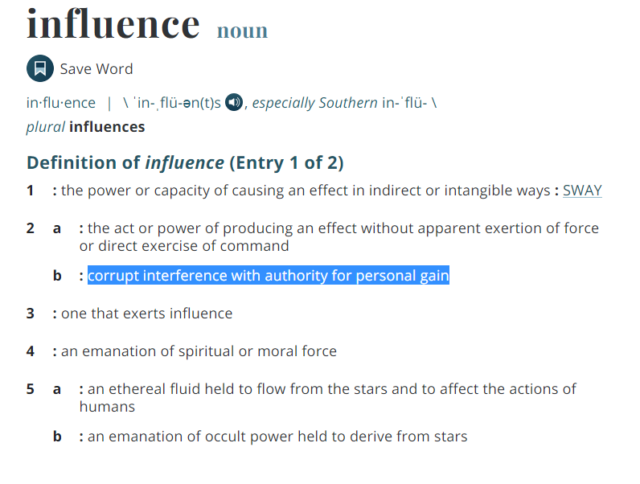

Time and attention are my most precious personal commodities, so personally, I don’t spend a lot of my time on social media. When I do, I read posts that bring value. Since the beginning of 2020, I noticed a shift within the feed on my social media sites. Specifically, I noticed more posts from ‘finfluencers’. Posts I’ve watched/read often tout buying ‘x’ stock or product and how you could make some ridiculous amount of money by following their advice. These individuals have this capability because their popularity or cultural status increased their reach and ultimately impacts their followers decision-making process. (Side-note, many of those posts include some expensive car, item or the ‘finfluencer’ was in an exotic/desired place to increase the effectiveness of their messaging)

Last week, a client reached out about an issue one of their children was facing. The son invested in a cryptocurrency called Luna. At one time it was one of the most valuable cryptocurrencies. Not surprisingly, Luna was also one that showed up prominently in my social media feeds. Originally, the sons investment gained, but recently Luna collapsed and he faces thousands of dollars in losses. This left the son and family with no real direction on how to proceed.

Although there is a lot of misleading information on social media platforms, not all of it is bad. I do believe that easy access to financial educational pieces with a few clicks is a positive, though I do encourage caution when proceeding and always encourage to do what a good consumer would do – seek understanding of all the ins/outs before acting on said information.

So, what should you understand and what actions should you take when seeking out financial advice on social platforms?

- Understand that anyone can post information about anything.

- Understand that you may not be getting all the information.

- Understand that ‘finfluencers’ are not subject to the same regulations as licensed financial professionals.

- Understand there may be undisclosed conflicts of interest. (ex. compensation)

- Understand the risks when deploying your money into a recommended investment.

- Understand the ‘finfluencers’ credibility and experience.

- Understand popularity does not always equal success.

- Understand your emotions and strive to keep them in check when hearing said information.

- Be a skeptic.

- Do your own research.

- Seek counsel from those you trust before acting.

If you or someone you know is looking for education on a financial topic or second opinion, don’t hesitate to reach out. At LeConte, we’ll give you more than 30 seconds and provide you fiduciary advice.