We sputtered from spring into summer with $5 dollar gas, unaffordable houses and stocks in free-fall. As Labor Day brings summer to a close, gas prices are down a decent amount. The stock market bounced back in the last two months. Biden even made college debt “disappear” without asking for a single vote to be cast on the subject.

Looks like smooth sailing into year end.

Or, maybe not.

Focus is shifting from a mixed earnings season for stocks back to the Federal Reserve and interest rates. Today Jay Powell, Fed chair, reminded the country that he wields more power as Federal Reserve Bank Chairman than Congress or the President. In a speech at the annual Jackson Hole, WY conference, Powell vowed to push his fight against inflation until he has a clear victory in hand. “Our aim is to avoid that outcome by acting with resolve now,” Powell said.

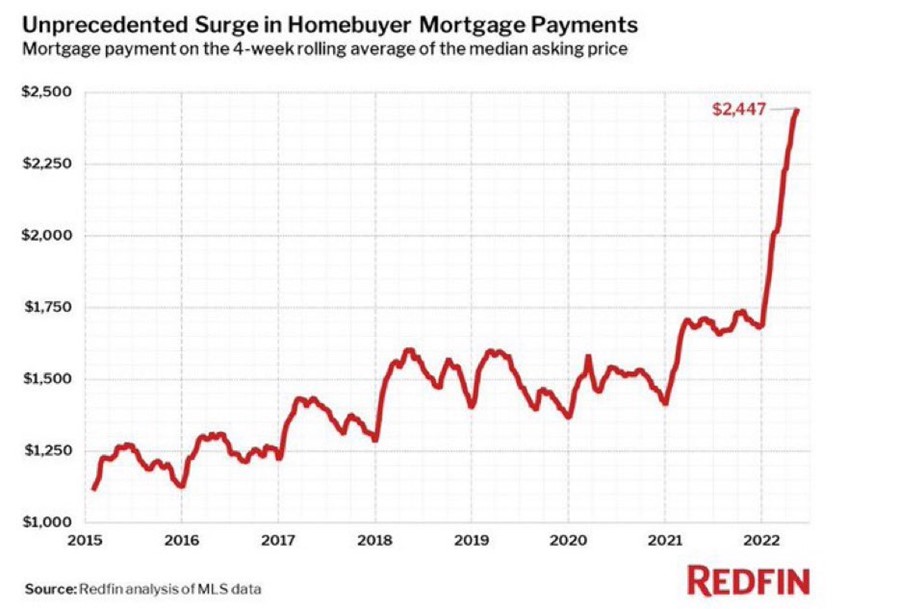

Our problem is the “weapons” that he is using to fight are our financial assets. By aggressively hiking rates this year, the Federal Reserve compounded potential homebuyers’ pain. Mortgage payments (a product of prices and interest rates) have skyrocketed 40% this year.

Powell reminded us that further rate increases he is planning will bring more pain and it will stay with us until he wins his inflation war. “These are the unfortunate costs of reducing inflation,” Powell said. “But a failure to restore price stability would mean far greater pain,” Powell justified. This puts the Fed on a precarious ledge. They are committed to killing inflation but the tools they wield exhibit a long lag between when they act and what the outcome of their actions eventually are. Powell is running the risk of pushing this fight harder at a time when excess inflation is already vanquished.

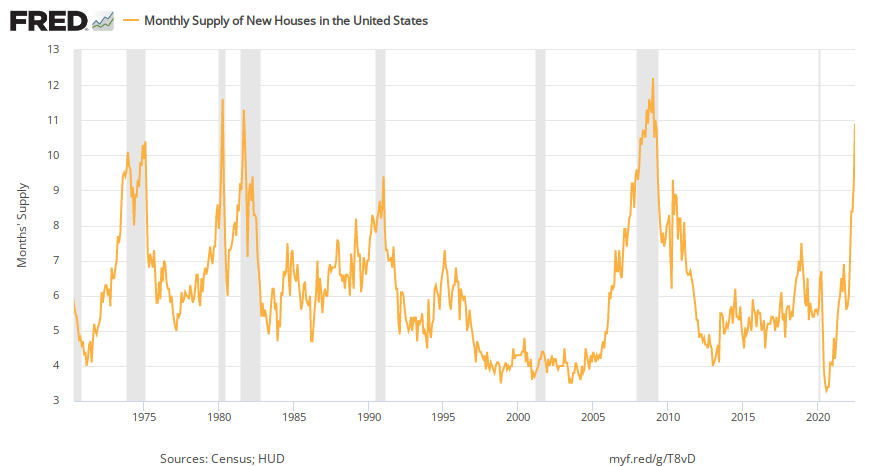

We can see signs of this in housing. As potential buyers are priced out of the market and walk away from purchases, we see weakness in housing that will soon exert a significant effect on the broad economy. The supply of unsold houses is almost 11 months’ worth nationally.

As you can see from the chart, this is worrisome. Since the 1970’s our economy went into recession (gray bars) every time supply crossed over 9 months. At the beginning of summer, we outlined several areas in our economy where we were dragging our anchor. Summer travel, decent earnings and a downturn in gas prices allowed the economy to make some progress.

Heading into fall the growing inventory of unsold homes coupled with persistently high gas prices and outrageous utility bills has consumers in a foul mood. This has me thinking of another nautical warning:

Before Powell’s speech, we sold down a few positions to raise cash for our clients. September and October are historically volatile months for investors. Letting the dust settle after Powell’s speech and watching to see if the Fed’s action matches their rhetoric is prudent.

“The two most powerful warriors are patience and time”. Leo Tolstoy