For anyone who does not have a credit history, the ability to buy a house, rent an apartment, lease a car etc. could be extremely difficult. Frequently I hear questions from family and friends, “What is the smart way to build credit?” There is more than one answer to this question, but this post will go into detail on two of the most popular ways to build credit, and just as importantly, once credit history is established, how to maintain a good credit score.

Methods:

- Become an authorized user on a family member or friend’s credit card – an authorized user is a person who is allowed to use someone else’s credit card – that of the primary cardholder. As an authorized user, you can piggyback off the primary cardholder’s hopefully good credit habits to establish your own credit history. Often times, the card issuer will issue a second card in the name of the authorized user, which is usually sent to the address of the primary cardholder. When the primary cardholder receives the second card, he or she can then ultimately decide if they want to give the card to the authorized user. The primary cardholder is responsible for making timely payments, and as such, the authorized user has no liability. This is an easy, low-risk way to build credit. Just make sure that your card issuer does indeed report credit activity to the credit bureaus, as some issuers do not.

- Get a secured credit card. These cards are usually easier to qualify for if your credit history is poor or non-existent. They work almost exactly like a traditional, unsecured credit card – you receive a credit limit, can incur interest charges and some even offer rewards. The main difference is the approved applicant is required to make a security deposit in order to receive a line of credit. The best way to approach this is to initially start with a modest deposit, make small purchases, and then pay it off at the end of the statement cycle. Once your account is open for approximately 6 months, there will be sufficient credit history to generate a credit score.

This is not an exhaustive list. There are additional methods that can be used to build credit such as reporting your rent and utility payments to the credit bureaus, credit-builder loans, etc. – which method(s) works best for you will depend on your specific situation. One is not better than the other.

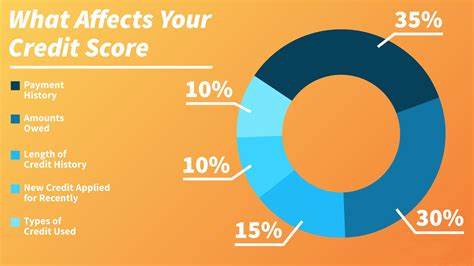

After credit history has been built, it is important to maintain a good credit score. The following outlines the 5 factors that determine your credit score, starting with the most important:

The three major credit bureaus (Equifax, Experian and TransUnion) consider the following:

- Payment history – 35%: make sure you pay your balance in full each month; lenders want to be sure that you will pay back your debt, and on time, when they are considering you for new credit.

- Credit utilization – 30%: the credit bureaus look at your credit utilization ratio as a key metric in determining your credit score – the ratio is calculated by taking the sum of all of your balances and dividing it by the sum of your card(s) credit limit(s); a credit utilization ratio below 10% is ideal, but do your best to keep it below 30%.

- Credit history length – 15%: this includes the age of your oldest credit account, the age of your newest credit account and then the average of all of your accounts. Generally, the longer your credit history, the higher your credit score.

- Credit mix – 10%: a diverse portfolio of credit accounts results in a higher score i.e. car loan, personal loans, credit cards etc.

- New credit – 10%: less is more in this instance as credit accounts recently opened and an increase in the number of hard inquiries that lenders have made can have a negative impact on your score.

Hopefully this article has given you some insight into the credit building process and empowered you to make smart decisions when it comes to your credit. Remember, Rome wasn’t built in a day. Give yourself time, be discipline(d) and stay purposeful!