Hurricane Warning

My vacation was cut short by the pending arrival of Hurricane Ian in the state of Florida. Fun fact 44% of all retired hurricane names (because of the damage they created) begin with the letter “I”. We knew when we booked a vacation in late September that storm season could change our plans so we were prepared for this. If you live in Florida, it is inevitable that a bad storm will hit your area. Armed with this realization, the goal is simple – avoid a direct hit. I grew up in Seminole County, Florida. Hurricane season was a right of passage for school kids here. When students were issued textbooks at the start of a new school season, local grocery stores handed out book covers that had maps of the Caribbean region. When a storm formed, our teachers wrote the latitude and longitude on the chalkboard. Students would map and track each storm on our book covers. Chalkboards and textbooks are rarely used in modern classrooms, but my old-fashioned Florida classrooms equipped me with first-hand knowledge that native Tennesseans don’t have.

The Sunshine State has become a very popular destination to thousands of new residents in the last few years. This migration is creating a problem during storm season. These newbie Floridians don’t have any hurricane storm experience.

Rules of Hurricane Season:

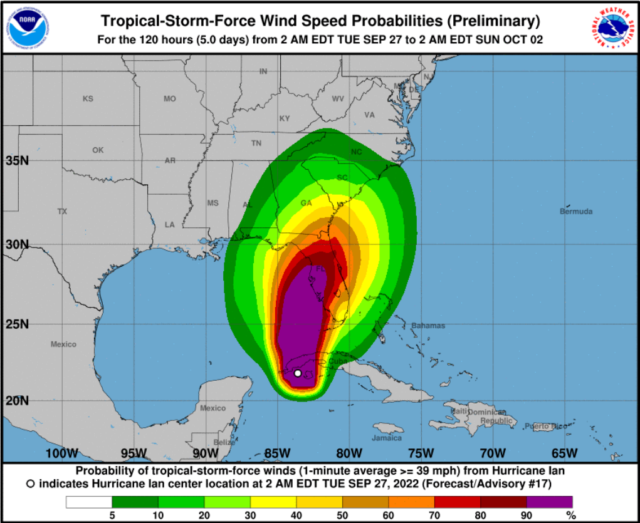

First Rule – know where the storms are.

Second Rule – have a list of essentials if normal public services are disrupted. Water, food and gasoline are obvious. Florida is very flat so inland residents fill sandbags ahead of time to buttress their doorways from high water. One transplanted New Yorker said he gave up shoveling snow for shoveling sand into sandbags this fall. As the storm approaches your location it’s crucial to understand how unpredictable the storms track will be. You won’t know exactly how close the storm will get until it’s too late to get out of its destructive path.

Most Important Rule – have an evacuation plan. Know when to leave, where to go and how far to get. We cut park reservations and our hotel stay a bit short, packed up and headed home before the storm moved inland. Residents closer to the coast boarded up their residence and headed inland earlier than we did because they were closer to the storm.

Surprisingly, non-residents are unaware of how easy it is to evacuate out of a hurricane’s most destructive forces. A coastal resident can drive less than an hour inland and find safety from the coastal surge. You don’t have to travel a day away to avoid that direct hit. You’re going to get rained on, maybe even lose electricity for a while, but you won’t take a direct hit.

Storm Season for Investors

September and October are frequently a stormy time for investors. 2022 is living up to that reputation. “Hurricane Powell” made landfall at the Fed meeting on September 21st. Markets were engulfed by a surge of doubt and fear over the Feds sketchy plans to combat inflation with higher rates even as housing is showing clear signs of fatigue. Mortgage rates are skyrocketing. Stocks plummeted back into bear market territory.

That was quick. The National Average 30 Year Mortgage Rate posted at 7.08% today.

— Jeffrey Gundlach (@TruthGundlach) September 28, 2022

Investors know that markets go up and down. They should not be surprised by this. Like booking a vacation in Florida in September, they need to be clear-headed about risks to their portfolio. The rules for investors are like a Floridian’s hurricane rules – do what you can to avoid a lethal direct hit. Be alert to sudden changes in the path of risk heading towards your portfolio. Seek high ground, be patient for opportunities after the storm passes.

Investment Survival Rule #1 (for the current environment) – “Know where the storm is.” Right now, this means don’t fight the Fed. Powell’s inflation fight is the eye of the storm right now. The Fed is raising rates and signaled their intention to raise more. Use what the Fed has done and will do to your advantage. We raised cash in investors accounts a month before the Fed meeting. Sure, we got “rained on” by Powell’s surprising announcement like other investors, but we didn’t take a direct hit, because we are under-weight the sectors that were in Hurricane Powell’s path.

Storm Clean-up

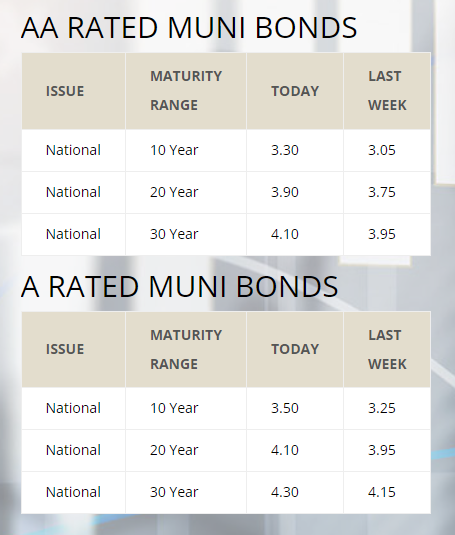

After the hurricane passes, that is when proper preparation can pay dividends. In the case of Hurricane Powell, interest rates have skyrocketed. This is bad for anyone who needs to borrow money, but it’s a huge opportunity for investors’ conservative dollars. High yielding bonds and stocks are easy to find right now. We have battled historically low yields for 10 years. Retired investors have experienced years of declines in the amount of interest that their safe investments earn. The massive spike in interest rates this year is a rare opportunity to dramatically increase your portfolio income from high quality bond investments. Steady income from stocks and bonds help to stabilize your portfolio from short term market swings and gives you a source of cash if opportunities arise.

After a hurricane wreaks havoc, coastal property gets cheaper because some folks don’t have the energy, drive or desire to rebuild. Bear markets do the same thing to stocks. Impatient investors are willing to sell good companies at low prices just to placate their immediate fears. As year-end 2022 approaches, investors will look for stocks to sell at a loss to create tax write-offs. As a general rule, I like to buy from distressed sellers if I can. The sellers’ level of pain improves my ability to dictate an aggressive price reduction. The goal for growth-oriented investors is to accumulate as many stock shares as you can afford until you retire and need to start drawing from your investments. If prices drop, like they did in September, you can increase your share count much faster. Do it!

The uncertainty in stocks may last into next year, but remind yourself that you are in the “share accumulation” game. Buy as many as you can, as cheap as you can, as long as you can. Your focus should be on the number of shares you have, not the current value of the shares you already own.

Let’s check back in November and see how we all managed through this time of uncertainty (but… opportunity). In the meantime, stay dry.