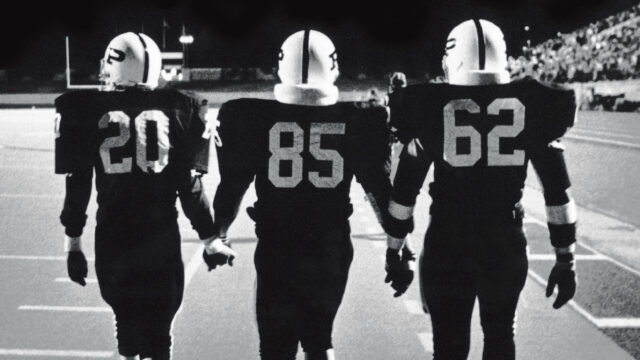

Growing up playing sports and currently watching my children compete, I’ve always been motivated by the coach’s speech encouraging the team to “finish”. It seems like no matter how prepared we feel going into the game, the last few minutes require focus and encouragement from our coaches.

The same can be said about our financial lives. We play many games through the seasons of life, and one of the annual struggles that we encounter is taxes. As we approach the finish line of the year 2022, there are a few specific items your financial coach should be encouraging you to concentrate on completing before year-end.

Maximizing Retirement Accounts

Probably the most important thing you can do every year to ensure you have the retirement you want is to maximize your 401k, IRA or other retirement account. These accounts have an annual limit for funding, and there’s a reason. The IRS knows that the benefit of a current tax deduction and tax-deferred growth until retirement is an extremely beneficial way of avoiding taxes. Your goal every year should be to contribute as much as you can to these accounts.

RMD

If you’ve reached 72 years of age, you must take Required Minimum Distributions (RMD) from your qualified retirement accounts. If you fail to make these distributions, the IRS will hit you with a 50% penalty on the amount you should have withdrawn. That’s a steep penalty for failing to keep your eye on the ball and make a simple distribution.

Defer Income

If you think your tax bill or bracket is going to be high for 2022, you should look for ways to defer income if possible. There are many ways to legally defer income into the next year such as deferring billing if self-employed, selling stocks after January 1st, or requesting bonuses be paid the next year.

The opposite may be true if your income is low in 2022 and you expect windfalls of income in 2023. In that case, you may desire to accelerate some income into 2022 to pay the lower tax versus in 2023.

Year-End Purchases

The Section 179 deduction and Bonus Depreciation are still great options to take advantage of at the end of 2022 if you need to lower your income. I never recommend only buying an asset for the tax deduction. However, if you need a new piece of equipment, the tax benefit may be greater for you now in 2022 as opposed to next year. It may not be a big item you decide to purchase but accelerating the payment of small bills that get you a deduction this year could be beneficial. It’s always a good evaluation to do before the calendar year ends.

Financial Planning

As we get ready to start a new year, this may be the time to get yourself a game plan for the future. You may be in the first half of your life or in the later innings of your work career, but it’s never too late to make those adjustments that will help you win with your finances.

We would love the opportunity to be teammates within the new year to help you and your family navigate this challenging game. Please reach out to us if you have interest in discussing how we can help. Let’s finish 2022 strong.