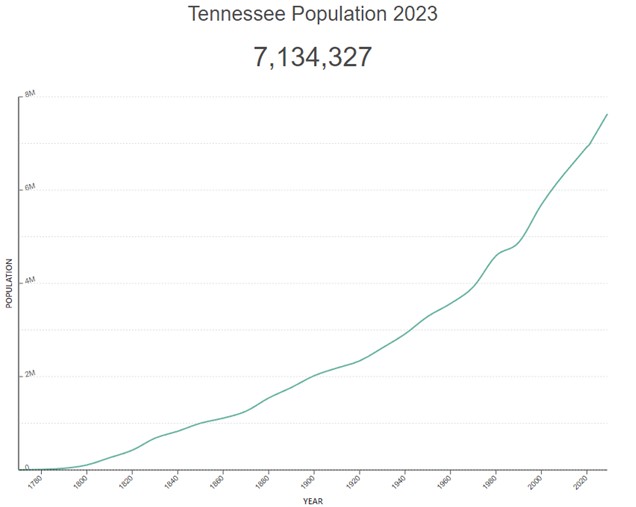

Tennessee population trends reflect the states status as a low tax, low unemployment destination for hundreds of thousands of new residents. In the last 5 years, our population grew from 6,800,000 to 7,134,327. This means more than 300,000 new residents need housing, schools, etc. Combined with an extended period of under-building after the 2008 GFC, Tennessee doesn’t have enough houses and apartments to meet the demand.

As demand outstripped supply in the state’s popular urban hubs, prices doubled from around $100 per square foot to more than $200 per square foot now. While it may be nice to see an estimate of what your house is worth after these dramatic moves, it comes with a downside. The obvious one is the cost of selling/relocating. You may get a great price for your current house, but your potential new home is going to be expensive too. Higher mortgage rates are compounding the cost of moving/upgrading so many homeowners are staying put and opting for home improvements.

Even if you decide to stay put in your current home, you’ll be paying for the increase in your home’s value. This year, Tennessee homeowners received a new property tax statement from their county tax assessor. While not as immediate as some homeowners’ fear, home value increases will mean higher property taxes in the near future.

Take time to review your current homeowner’s insurance policy. Since your annual homeowner’s premium is probably paid out of your mortgage escrow account, it’s easy to overlook it. Property insurance companies include reasonable value increases in many consumer policies. In normal times this keeps your coverage in line with what you need. If you went down the remodel/renovation path, your insurance coverage may be lacking. The rapid increase in Tennessee home prices leaves many homeowners with inadequate coverage from a catastrophic event. The cost of bumping your homeowner’s coverage will mean an adjustment to your mortgage escrow account and eventually your monthly mortgage payment. This is a small price for the peace of mind that comes from knowing you won’t be forced out of your house if a fire or other disaster hits.