Finance scholars have produced volumes of research on investor behavior and financial decision making. The field of behavioral science is fascinating because we can easily inject ourselves into the discussions and circumstances to validate what scientist postulate. Experience is a great teacher in these matters, but even bad experiences aren’t enough to keep our inner moth from seeking out the warmth of a flame.

The “Crowded Trade” is a simple concept for investors to contemplate. As the name implies, it only requires investors to understand where money is flowing, what’s generating popular buzz around the commentary channels and why the volume is higher on a certain investment narrative compared to others.

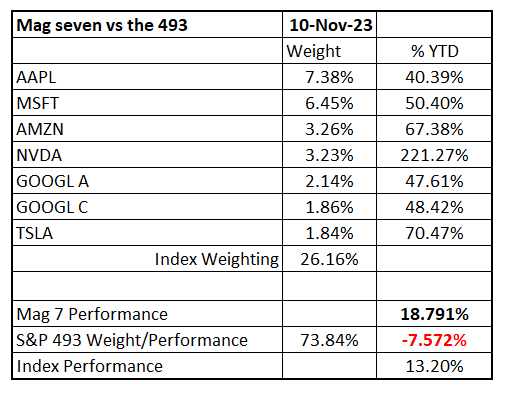

A well-known crowded trade in 2023 is the known as the “Magnificent 7”. The Mag 7 are the top (and largest) seven names in the S&P 500 stock index. Due to the cap-weighted construction of the index, the Mag 7 companies make up 26% of the whole index. Because of this overweight structure, they wield heavy influence over the index’s performance. In 2023 these seven stocks are up about 18.8% while the other 493 stocks in the index are down an average of 7.5%. Without the huge performance of these seven names the index would be creating losses for investors this year.

There are justifiable reasons for the run-up in the Mag-7. They are great companies. Smart investors though, seek to differentiate between a great company and a great stock. Mean reversion is the term that market statisticians use to describe the other side of these periods of dramatic outperformance. After huge price gains, a company’s valuation metrics reach a peak and the margin for financial errors become very thin. Eventually the financial forces (new products, strong sales, mergers) that fueled huge gains wane and execution errors produce a downdraft in stock prices. Even now, Apple is struggling to grow iPhone sales in China.

Whether they realize it or not, investors who are invested in an S&P 500 index fund are in a very crowded trade. 26% of their money is likely to revert to a period of average (or worse) performance. We could do a similar examination of other popular stock indices and discover other concentrated positions in over-valued stocks. Exercising diligence to see where the crowded trades are is smart investing. It should be obvious that stocks up 40%- 220% in less than a year aren’t the smartest place to have a lot of money invested.

There is another extremely crowded trade that every investor needs to understand – cash.

After suffering through years of almost zero interest on savings accounts, investors have flocked to short term cash instruments that are yielding more than 5 ½%. Earlier this year, LeConte encouraged investors and savers to maximize the return on their idle cash. This is a great opportunity to finally earn real money on your excess cash. Investors perceive very little risk in taking advantage of the spike in savings rates. Inflows into high yielding money market funds and short-term Treasury obligation have been massive. This is a textbook “crowded trade” and there is a downside to sitting in cash even if you are making more than 5%.

Mean reversion in rates happens when the Fed finally does enough damage to the economy that it stalls out. The impact of mortgage rates around 7-8% means that most home buyers are getting squeezed out of the market. As the economy falters, the Fed eventually starts cutting rates which triggers an avalanche of investors rushing to find a new place for their cash.

Yields on some new government and corporate bond issues recently touched 7%, LeConte locked in these high yields in range of longer maturity government, corporate and municipal bonds for clients. This is a unique expertise that our asset management team provides to clients. We constructed diversified income portfolios with assets that clients don’t want to invest in the stock market. The result? Our retired investors can comfortably rely on their portfolio income for years to come even if the Fed cuts rates in 2024 or 2025.

While cash yields are putting smiles on our faces, don’t wait too long with the rest of the crowd. When things change, the exits get very crowded and chaotic.